So this past month has been crazy (crazy fun?) I went to Utah for a week with the kids to celebrate my grandparents' 50th wedding anniversary. I was able to meet up with a few of my friends and have a lot of fun. It was nice having extra help with the kids ... Mom doesn't get much sleep when she's sleeping in the same room as both of her kids. Anyway. Hopefully some day I'll be able to see the nice family photos we took.

Since Mark got a new job last year, we've been thinking about buying additional life insurance. Someone came by with an interesting investment thing where it's like part of it is life insurance and part of it is an investment with a guaranteed 2% return and a 12% cap, and it's got some kind of tax shelter associated with it because of the kind of investment it is. (Fair Tax, FAIR TAX, why can people make up stuff like this??!!!)

Anyway, in case you don't know, when you sign up for life insurance they come and weigh you and take your blood and test it for stuff to make sure you're not about to die from cancer. When Mark got his blood work back, his levels came back high for stuff that could be related to his liver. The life insurance company wasn't worried about that at all (but they were concerned about his Factor V Leiden, a blood clotting disorder we already know about which is not a big deal but whatever) but they couldn't give us a better deal than we already have on Mark's life insurance (yay, BYU alumni stuff!!) so we decided we'll get healthier and try again later for additional term life insurance.

Looking at the liver stuff, though, we decided to go see a doctor to figure out what's going on and what we can do. After a few doctor's visits and ultrasounds and whatnot, the doctor suggested Mark is developing a fatty liver and told him the best way to treat it would be to lose weight and go on a low-carb diet, "such as Atkins or South Beach."

So I'd heard of Atkins before, but not South Beach, and I was kind of excited that now we HAVE to get healthy because a doctor told Mark to lose weight. We've been half-heartedly "eating healthy" and working out, but we haven't really bothered to lose much weight because, heck, it's not like we've had to buy bigger clothes lately. And being pregnant gave me an excuse to not fit into anything anyway. ;)

I have a hard time figuring out what to cook (we love stir fry with lots of rice) because neither Mark nor I particularly like vegetables (stir-fry is the only way we're eating any) and Mark is allergic to half the fruits under the sun (apples, pears, peaches, cherries, pretty much anything with a pit...) So ... whatever.

Anyway, at the beginning of the month, Mark decided to cut down on carbs. Carmen wanted me to bake a birthday cake for her ponies (why not?) and Mark only ate a piece or two of it. I would make stir fry, and he would skip the rice. Stuff like that. I checked out a bunch of South Beach Diet books from the library and told him to skim through the recipes and find stuff he wanted to try (turns out he doesn't want any of it. All of the recipes are kind of specific and use weird ingredients we wouldn't use otherwise. Plus, they advocate the use of sugar substitutes. Blech, frankenfoods!)

We decided we would "officially" start our diet after I got back from vacation. I mean, there's no way I'm going to NOT eat the tortilla from my Cafe Rio salad, and I AM going to go to JCW's!! Neither of those places exist in Texas! A few days before I left (my vacation started on a Tuesday) Mark decided he was "officially" starting the South Beach Diet.

The way the SBD works is at the beginning, for 2 weeks, you cut all carbs out of your diet. No bread, no potatoes, no pasta, no sugar, NO FRUIT. They have some other guidelines, too, like you're supposed to only have reduced-fat milk and cheese and you're supposed to have a limit on the number of pistachios/cashews/etc you can eat, and I *think* they recommend Canadian bacon over regular bacon (Mark hates Canadian bacon) ... and Mark pretty much ignored that and went with the parts of the diet he agreed with that sounded ... well ... more sound. There is some diet/nutrition stuff we don't necessarily buy into. I'm not about to go below 2% milk because of the stuff they do to milk when you get down to 1% and skim. Mark is not convinced normal bacon is worse for you than frankenfooded bacon.

Supposedly, the goal of Phase 1 of the South Beach diet is to not spike your blood sugar, and hopefully get your blood chemistry back to normal. It will also kick your sugar/carb cravings. Carbs are easy energy and not very filling. Processed carbs are practically predigested for you, so you get lots of energy for little effort and maybe it helps you gain weight in your belly. Come to think of it, the skinny people I knew eat very few refined carbs and have lots of fiber ... so they might be onto something there.

So, now it's the end of August and we've had a little bit of a taste of a change of lifestyle ... Want to know how it went? Stay tuned!

Tuesday, August 28, 2012

Thursday, August 9, 2012

Reservations about the Fair Tax

Oh snap! This was supposed to post weeks ago but somehow it never made it out of my drafts!! (August 27, 2012)

Okay, quick revert back to the Fair Tax.

I have a few reservations about it, because of the sorts of things that would be taxed. The whole deal about the Fair Tax is that "everything" is taxed ... except for education. One of the FAQ's asks, "Why not just exempt necessities, like food and medicine?" The problem is, that would open the floodgates for lobbyists and special interests to come in and be like, "Give me special treatment!" ... and isn't that what the whole problem is with our current tax system anyway?

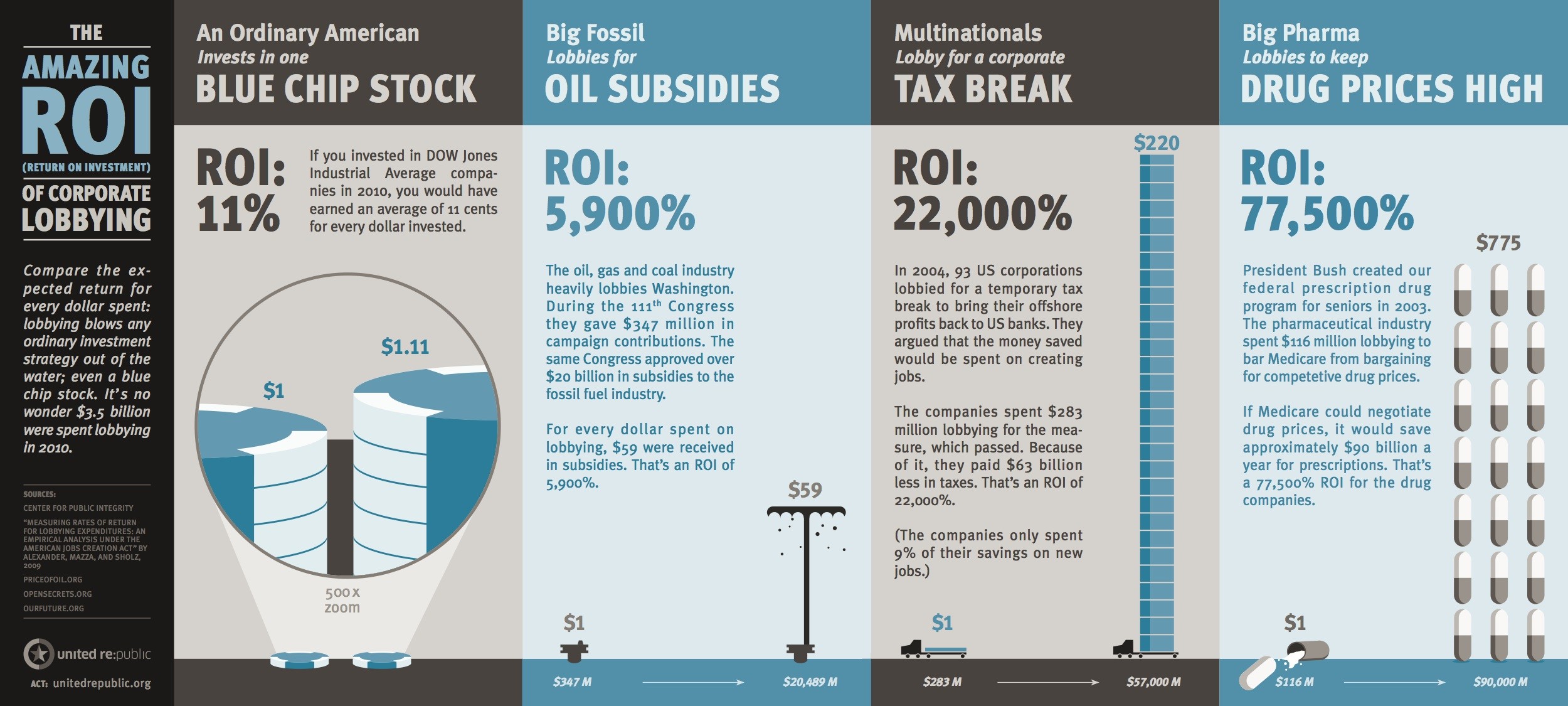

(When I rule the world, all lobbyists will be fired. and if they don't go home, I will line them up and shoot them. I hate lobbyists and special interests. http://www.npr.org/blogs/money/2012/01/06/144737864/forget-stocks-or-bonds-invest-in-a-lobbyist)

I mean, check it out:

It will make you crazy!

Random thought I just had: What qualifies as "education"? Would preschool count, or is it just like public kindergarten through college (or trade school, or whatever post-secondary training you want)?

Anyway. The Fair Tax also taxes RENT and HEALTH CARE. So ... you'd be paying tax on that $30,000 surgery. And then with the way insurance companies currently are, are you paying tax on what the hospital bills you, or what the insurance companies pay, or what? More about that in a second, I promise.

No, just kidding. I just wanted to say this wouldn't work because in my world, the bulk of health care would be a public good, not a private one. So maybe just the privately-run health care businesses would need to tax. I figure the basic government health care wouldn't be the best, so people can pay for fancier health care just like we pay for fancier private schools.

Back to rent.

It seems kind of crazy to tax rent because it would tack on $300 to a $1000 rent. (A 23% inclusive tax comes out to a 30% exclusive tax. I wasn't 100% positive of that when I wrote my previous entry because I couldn't remember the source I got it from so I didn't write the 30% number.) And I am renting our house in American Fork out to our friends, and it's confusing enough filling out the income tax forms on it. No, wait, scratch that, I think it's probably more complicated NOW calculating income and expenses and doing my income tax returns than it would be to figure out how to pay the sales tax to the government. But how would they even keep track of ME renting out MY place to my friends because we can't afford to sell our house ...? Fair Tax talks about how it gets rid of tax evasion problems (and oh yes it does, oh Fair Tax, how I love you and your simplicity) ... but ... like ... I don't know.

I guess I feel more comfortable about them taxing rent because you DO get to take your entire paycheck home. Your. Entire. Paycheck. Can you imagine?!?! And you get the prebate every month, so as your family gets bigger and you need a bigger place, you get a bigger prebate that covers more of your housing costs.

The Fair Tax also charges tax on interest. Currently, so much of our economy is based on borrowing (which, in case you don't remember, is a really bad idea, according to the prophets.) So a lot of people will be irritated that they're paying taxes on interest. But again - at the end of the day, is that such a bad idea? Maybe people will learn how to live within their means again!

Some people also complain that the FairTax isn't progressive enough, because the top 1% derive most of their income from capital gains, and that money is reinvested into the economy and isn't spent on new goods and services. But ... why are we taxing people for making money they're not spending anyway ...? A friend once asked me, "If the money's ultimately going to be spent somewhere anyway, does it really matter when it's taxed?" I think the answer is yes, and the two words I think that best describe it are: compound interest.

Also, this is a problem I have with both the Fair Tax our current income tax system: Cost of living is different from city to city. So for someone in New York City to have the same prebate as someone with the same size family in Mississippi ... the money just wouldn't go as far. So I would think that local governments would have to determine poverty levels or prebate levels for families of different sizes, and NOT have it be a blanket federal number applied to the whole nation.

I believe more local(ized?) governments are more effective than the federal government. If only our government was set up a bit more like our Church leadership, huh?

Anyway, all in all, I think the Fair Tax is a pretty good idea, and a pretty fair idea (even though it "doesn't tax the rich enough"). I don't like lobbyists in Washington and I don't like how the government works so hard to influence people's personal decisions. Both the Democrats and Republicans do it in different facets of our lives ... and that's why I'm a Libertarian.

Have you heard of the great Libertarian conspiracy? They want to take over the government, then leave you alone.

Okay, quick revert back to the Fair Tax.

I have a few reservations about it, because of the sorts of things that would be taxed. The whole deal about the Fair Tax is that "everything" is taxed ... except for education. One of the FAQ's asks, "Why not just exempt necessities, like food and medicine?" The problem is, that would open the floodgates for lobbyists and special interests to come in and be like, "Give me special treatment!" ... and isn't that what the whole problem is with our current tax system anyway?

(When I rule the world, all lobbyists will be fired. and if they don't go home, I will line them up and shoot them. I hate lobbyists and special interests. http://www.npr.org/blogs/money/2012/01/06/144737864/forget-stocks-or-bonds-invest-in-a-lobbyist)

I mean, check it out:

It will make you crazy!

Random thought I just had: What qualifies as "education"? Would preschool count, or is it just like public kindergarten through college (or trade school, or whatever post-secondary training you want)?

Anyway. The Fair Tax also taxes RENT and HEALTH CARE. So ... you'd be paying tax on that $30,000 surgery. And then with the way insurance companies currently are, are you paying tax on what the hospital bills you, or what the insurance companies pay, or what? More about that in a second, I promise.

No, just kidding. I just wanted to say this wouldn't work because in my world, the bulk of health care would be a public good, not a private one. So maybe just the privately-run health care businesses would need to tax. I figure the basic government health care wouldn't be the best, so people can pay for fancier health care just like we pay for fancier private schools.

Back to rent.

It seems kind of crazy to tax rent because it would tack on $300 to a $1000 rent. (A 23% inclusive tax comes out to a 30% exclusive tax. I wasn't 100% positive of that when I wrote my previous entry because I couldn't remember the source I got it from so I didn't write the 30% number.) And I am renting our house in American Fork out to our friends, and it's confusing enough filling out the income tax forms on it. No, wait, scratch that, I think it's probably more complicated NOW calculating income and expenses and doing my income tax returns than it would be to figure out how to pay the sales tax to the government. But how would they even keep track of ME renting out MY place to my friends because we can't afford to sell our house ...? Fair Tax talks about how it gets rid of tax evasion problems (and oh yes it does, oh Fair Tax, how I love you and your simplicity) ... but ... like ... I don't know.

I guess I feel more comfortable about them taxing rent because you DO get to take your entire paycheck home. Your. Entire. Paycheck. Can you imagine?!?! And you get the prebate every month, so as your family gets bigger and you need a bigger place, you get a bigger prebate that covers more of your housing costs.

The Fair Tax also charges tax on interest. Currently, so much of our economy is based on borrowing (which, in case you don't remember, is a really bad idea, according to the prophets.) So a lot of people will be irritated that they're paying taxes on interest. But again - at the end of the day, is that such a bad idea? Maybe people will learn how to live within their means again!

Some people also complain that the FairTax isn't progressive enough, because the top 1% derive most of their income from capital gains, and that money is reinvested into the economy and isn't spent on new goods and services. But ... why are we taxing people for making money they're not spending anyway ...? A friend once asked me, "If the money's ultimately going to be spent somewhere anyway, does it really matter when it's taxed?" I think the answer is yes, and the two words I think that best describe it are: compound interest.

Also, this is a problem I have with both the Fair Tax our current income tax system: Cost of living is different from city to city. So for someone in New York City to have the same prebate as someone with the same size family in Mississippi ... the money just wouldn't go as far. So I would think that local governments would have to determine poverty levels or prebate levels for families of different sizes, and NOT have it be a blanket federal number applied to the whole nation.

I believe more local(ized?) governments are more effective than the federal government. If only our government was set up a bit more like our Church leadership, huh?

Anyway, all in all, I think the Fair Tax is a pretty good idea, and a pretty fair idea (even though it "doesn't tax the rich enough"). I don't like lobbyists in Washington and I don't like how the government works so hard to influence people's personal decisions. Both the Democrats and Republicans do it in different facets of our lives ... and that's why I'm a Libertarian.

Saturday, August 4, 2012

I love the Fair Tax!

Okay, so there's this thing I love. It's called the FairTax. Basically, imagine this:

There's no income tax. There's no corporate income tax. There's no IRS. There's no April 15.

What there IS, is a 23% federal sales tax on consumption of new goods. That means, you go to the store and buy something, you pay 23% tax. You get a haircut, you pay 23% tax. You buy a new car (or a new house!), you pay 23% tax. You buy something from a consignment shop. No tax. You buy a used car. No tax. (Well, no federal sales tax.) But guess what? You get to take your WHOLE PAYCHECK HOME.

But our current tax system is "progressive," you say! I put "progressive" in quotes, because now that I think about it, the 15% investment income tax rate makes it so that people who make most of their money from investments (ie. those super-rich investors the 99% are complaining about) end up paying at a lower income tax rate than those who make their money doing physical work. And most people who have so much money to invest hire someone else to do the investing so it's not like they're doing much work to earn those dividends, right? Investing IS valuable and important to the economy (when people want to start up a business they need capital) but is it really worth giving these people special income tax treatment?

Oh boy, sorry, I really don't actually want to get into that conversation right now. Ahem.

Progressive taxes ... the idea that those who have less pay less in taxes because they need more of their income, and those who have more can afford to give more in taxes because they can provide for their own basic needs and then some. So supposedly there are people below the poverty level who pay no tax (or negative tax), and then there are people in varying tax brackets who pay the same percent in tax up to a certain level of income, then a higher percent of tax for the next level of income, then when you make a ton of money you're supposed to give up even MORE of that in taxes ... So the marginal returns you get as you make more money get smaller because more of it gets eaten up in taxes. Something like that. In theory. And if you are married and have to provide for your family (spouse, kids, etc) then you get to claim these exemptions and stuff so you get to keep more of your money. Because, let's face it, if you earn the same amount of money as another guy but you have 2 more kids, if you both pay the same amount in taxes, you're going to have less disposable income because you have to feed, clothe, and house your kids.

http://www.fairtax.org/site/PageServer?pagename=HowFairTaxWorks

The FairTax works out being "progressive" because it looks at a whole household and estimates the amount of money they'll need to provide for the basics (ie. what's the poverty level for a given household size?) Then every household gets a "prebate" check from the government to cover their basic expenses. So if you spend money at the poverty level, your prebate check equals your sales tax. If you spend more than that, it's like you pay a little bit of "income tax" (spending/consumption tax) ... up to a limit of 23%. So if you're a millionaire and you spend a million bucks on new goods, the amount of sales tax you pay is gonna be WAAAAY over that little prebate you got and your effective tax rate will be 22.9999999%.

Your household is determined by the number of people who live in your house with valid social security numbers. THAT'S IT.

The nice thing about this is that it taxes everybody so it makes it hard for people to evade taxes. You know, illegals getting paid cash under the table don't pay income taxes. But here, if they don't have a valid social security number, not only do they NOT get a prebate, they also have to pay federal sales tax on the new stuff they buy! Booya! That would encourage people to gain citizenship, wouldn't it? This also solves one of the same-sex marriage problems. It doesn't discriminate according to marital status. It gets the government out of married, so homosexual couples can have the same tax benefits as heterosexual couples ... and, hey, polygamists too and people who just want to live together. Why not? It's just taxes.

Anyway. You might want to check it out.

http://www.fairtax.org/site/PageServer?pagename=FAQs

Chew on it for a while. It sounds totally weird at first, but it might just grow on you.

Gary Johnson 2012!

I can no longer deny that I am a libertarian.

(There will be a future post about some of my reservations about the fair tax ... but that would be too overwhelming in one post. This post is too long already.)

There's no income tax. There's no corporate income tax. There's no IRS. There's no April 15.

What there IS, is a 23% federal sales tax on consumption of new goods. That means, you go to the store and buy something, you pay 23% tax. You get a haircut, you pay 23% tax. You buy a new car (or a new house!), you pay 23% tax. You buy something from a consignment shop. No tax. You buy a used car. No tax. (Well, no federal sales tax.) But guess what? You get to take your WHOLE PAYCHECK HOME.

But our current tax system is "progressive," you say! I put "progressive" in quotes, because now that I think about it, the 15% investment income tax rate makes it so that people who make most of their money from investments (ie. those super-rich investors the 99% are complaining about) end up paying at a lower income tax rate than those who make their money doing physical work. And most people who have so much money to invest hire someone else to do the investing so it's not like they're doing much work to earn those dividends, right? Investing IS valuable and important to the economy (when people want to start up a business they need capital) but is it really worth giving these people special income tax treatment?

Oh boy, sorry, I really don't actually want to get into that conversation right now. Ahem.

Progressive taxes ... the idea that those who have less pay less in taxes because they need more of their income, and those who have more can afford to give more in taxes because they can provide for their own basic needs and then some. So supposedly there are people below the poverty level who pay no tax (or negative tax), and then there are people in varying tax brackets who pay the same percent in tax up to a certain level of income, then a higher percent of tax for the next level of income, then when you make a ton of money you're supposed to give up even MORE of that in taxes ... So the marginal returns you get as you make more money get smaller because more of it gets eaten up in taxes. Something like that. In theory. And if you are married and have to provide for your family (spouse, kids, etc) then you get to claim these exemptions and stuff so you get to keep more of your money. Because, let's face it, if you earn the same amount of money as another guy but you have 2 more kids, if you both pay the same amount in taxes, you're going to have less disposable income because you have to feed, clothe, and house your kids.

http://www.fairtax.org/site/PageServer?pagename=HowFairTaxWorks

The FairTax works out being "progressive" because it looks at a whole household and estimates the amount of money they'll need to provide for the basics (ie. what's the poverty level for a given household size?) Then every household gets a "prebate" check from the government to cover their basic expenses. So if you spend money at the poverty level, your prebate check equals your sales tax. If you spend more than that, it's like you pay a little bit of "income tax" (spending/consumption tax) ... up to a limit of 23%. So if you're a millionaire and you spend a million bucks on new goods, the amount of sales tax you pay is gonna be WAAAAY over that little prebate you got and your effective tax rate will be 22.9999999%.

Your household is determined by the number of people who live in your house with valid social security numbers. THAT'S IT.

The nice thing about this is that it taxes everybody so it makes it hard for people to evade taxes. You know, illegals getting paid cash under the table don't pay income taxes. But here, if they don't have a valid social security number, not only do they NOT get a prebate, they also have to pay federal sales tax on the new stuff they buy! Booya! That would encourage people to gain citizenship, wouldn't it? This also solves one of the same-sex marriage problems. It doesn't discriminate according to marital status. It gets the government out of married, so homosexual couples can have the same tax benefits as heterosexual couples ... and, hey, polygamists too and people who just want to live together. Why not? It's just taxes.

Anyway. You might want to check it out.

http://www.fairtax.org/site/PageServer?pagename=FAQs

Chew on it for a while. It sounds totally weird at first, but it might just grow on you.

Gary Johnson 2012!

I can no longer deny that I am a libertarian.

(There will be a future post about some of my reservations about the fair tax ... but that would be too overwhelming in one post. This post is too long already.)

Thursday, August 2, 2012

Feeling hormonal >:( (probably from breastfeeding)

I want to complain for a few minutes.

I haven't been blogging lately because I'm too tired and don't have the brainpower to write something coherent. I haven't even written in my own personal journal. I'm exhausted. The baby keeps me up a lot at night, and I keep getting sick with colds. Blech! All I want to do is catch a nap.

Nursing hormones are not so much fun. Especially not in the summer. Did you know you can get hot flashes from nursing? I don't remember getting hot flashes when nursing Carmen! That's it; I'm having my next kid in October. I don't care if I spend the summer being pregnant. Maybe I'll change my mind if I spend a summer being pregnant. ;) But, dang it, Texas, why do you have to be so hot?! Heat rash is not fun.

I also discovered where the huge bruises on my thighs came from ... while I was lugging Mace's car seat up the two flights of stairs to get to our apartment. The car seat goes bonk, bonk, bonk on my leg on each step as I lug a car seat, diaper bag, and multiple bags of groceries up to our apartment. Ugh, and I wonder why I don't try to get out more?

Our lease is up September 30, so in a few weeks I can start looking for a house to rent! Mark wants to stay within the ward boundaries. I can't start looking yet because they won't let you turn in an application until 30 days before your desired move-in date. I don't want to pay double rent ... but rent and a half would be okay with me. It kind of gives me heartburn to think about the fact that we have to turn in a 60-day move-out notice, but can't give a 60-day move-IN notice! Augh, moving is such a pain!

BUT THIS APARTMENT IS SO SMALL AND CLAUSTROPHOBIC AND ON THE THIRD FLOOR AUGH I WANT OUT. How have I survived here for the past year?! Some day (soon!) I will be able to live in a house ... with a yard ... and possibly trees ... and Carmen can play outside while I am inside with the baby ... you can't exactly send your kid outside to play when you live in an apartment complex. The porch is not the same. Waaah. *melts into puddle of not-wanting-to-do-anythingness*

I bet it's just the hormones driving me crazy now. ;)

Mace, I love you, but I am so looking forward to when you stop eating every 3 hours. I hate how guilty the breastfeeding advocates make me feel when they talk about exclusive breastfeeding. I am so jealous of the other people in my Bradley class who DO do the whole feed-your-kid-formula-and-even-put-rice-cereal-in-their-bottle-so-they'll-sleep-longer thing. Oh my heck I wish I could get more than 4 hours of sleep at a time. But I can't get over that mental block of, "It's so selfish to feed your kid formula just so you can get some sleep."

But let's see ... do I want to be a breastfeeding HOMICIDAL MANIAC because I don't get enough sleep, or a major disappointment to the World Health Organization and the American Academy of Pediatrics because I'm one of the 80-someodd-percent of non-exclusively breastfeeding moms?

It's a bit like saying, "Oh, man, we are SO DISAPPOINTED because so few people are on 100% whole-foods diets." Like, dang, I had a bowl of cereal and blew it.

I mean, like ... this New York breastfeeding thing really ticks me off. The whole Baby Friendly initiative thing ticks me off. Locking away formula and pacifiers? Seriously? Lecturing moms about bottle feeding and pacifier use? (Men, if you don't know what breastfeeding feels like, have someone pinch and twist your nipples then rub them with sandpaper then attach a vacuum to them. And do that for about 20 minutes at a time. When your nipples are bleeding, keep doing it for a while. Then imagine what it would feel like having someone lecture you about how if you don't let someone continue to sandpaper and vacuum-suck your twisted nipples, you will have all of these problems.)

And did you know that pacifier use can actually enhance breastfeeding? When your nipples are sore in those early days of breastfeeding, you really wish your baby would only use your boobs for food and not for comfort.

You know an easier way to get women to successfully breastfeed? DON'T SEND THEM HOME WITH FORMULA AND COUPONS FOR FORMULA. Problem solved. Send them home with 20 bucks. Then they can use that money to either buy formula or lactation tea. Freedom of choice, ain't it great?! Or if you're going to send them home with presents and not cash, give 'em a fruit basket (oh, wait, you're telling me hospitals don't send women home with free formula just 'cause they're nice???)

Also, next time I have a baby, I'm sneaking in my own pacifiers. When the nurse came in to lecture me on pacifier use and breastfeeding, I wanted to tell her to can it and just give me the d*mn pacifier. My boobs hurt and I'm not suddenly going to give my baby formula. And if I did, IT'S MY CHOICE.

I haven't been blogging lately because I'm too tired and don't have the brainpower to write something coherent. I haven't even written in my own personal journal. I'm exhausted. The baby keeps me up a lot at night, and I keep getting sick with colds. Blech! All I want to do is catch a nap.

Nursing hormones are not so much fun. Especially not in the summer. Did you know you can get hot flashes from nursing? I don't remember getting hot flashes when nursing Carmen! That's it; I'm having my next kid in October. I don't care if I spend the summer being pregnant. Maybe I'll change my mind if I spend a summer being pregnant. ;) But, dang it, Texas, why do you have to be so hot?! Heat rash is not fun.

I also discovered where the huge bruises on my thighs came from ... while I was lugging Mace's car seat up the two flights of stairs to get to our apartment. The car seat goes bonk, bonk, bonk on my leg on each step as I lug a car seat, diaper bag, and multiple bags of groceries up to our apartment. Ugh, and I wonder why I don't try to get out more?

Our lease is up September 30, so in a few weeks I can start looking for a house to rent! Mark wants to stay within the ward boundaries. I can't start looking yet because they won't let you turn in an application until 30 days before your desired move-in date. I don't want to pay double rent ... but rent and a half would be okay with me. It kind of gives me heartburn to think about the fact that we have to turn in a 60-day move-out notice, but can't give a 60-day move-IN notice! Augh, moving is such a pain!

BUT THIS APARTMENT IS SO SMALL AND CLAUSTROPHOBIC AND ON THE THIRD FLOOR AUGH I WANT OUT. How have I survived here for the past year?! Some day (soon!) I will be able to live in a house ... with a yard ... and possibly trees ... and Carmen can play outside while I am inside with the baby ... you can't exactly send your kid outside to play when you live in an apartment complex. The porch is not the same. Waaah. *melts into puddle of not-wanting-to-do-anythingness*

I bet it's just the hormones driving me crazy now. ;)

Mace, I love you, but I am so looking forward to when you stop eating every 3 hours. I hate how guilty the breastfeeding advocates make me feel when they talk about exclusive breastfeeding. I am so jealous of the other people in my Bradley class who DO do the whole feed-your-kid-formula-and-even-put-rice-cereal-in-their-bottle-so-they'll-sleep-longer thing. Oh my heck I wish I could get more than 4 hours of sleep at a time. But I can't get over that mental block of, "It's so selfish to feed your kid formula just so you can get some sleep."

But let's see ... do I want to be a breastfeeding HOMICIDAL MANIAC because I don't get enough sleep, or a major disappointment to the World Health Organization and the American Academy of Pediatrics because I'm one of the 80-someodd-percent of non-exclusively breastfeeding moms?

It's a bit like saying, "Oh, man, we are SO DISAPPOINTED because so few people are on 100% whole-foods diets." Like, dang, I had a bowl of cereal and blew it.

I mean, like ... this New York breastfeeding thing really ticks me off. The whole Baby Friendly initiative thing ticks me off. Locking away formula and pacifiers? Seriously? Lecturing moms about bottle feeding and pacifier use? (Men, if you don't know what breastfeeding feels like, have someone pinch and twist your nipples then rub them with sandpaper then attach a vacuum to them. And do that for about 20 minutes at a time. When your nipples are bleeding, keep doing it for a while. Then imagine what it would feel like having someone lecture you about how if you don't let someone continue to sandpaper and vacuum-suck your twisted nipples, you will have all of these problems.)

And did you know that pacifier use can actually enhance breastfeeding? When your nipples are sore in those early days of breastfeeding, you really wish your baby would only use your boobs for food and not for comfort.

You know an easier way to get women to successfully breastfeed? DON'T SEND THEM HOME WITH FORMULA AND COUPONS FOR FORMULA. Problem solved. Send them home with 20 bucks. Then they can use that money to either buy formula or lactation tea. Freedom of choice, ain't it great?! Or if you're going to send them home with presents and not cash, give 'em a fruit basket (oh, wait, you're telling me hospitals don't send women home with free formula just 'cause they're nice???)

Also, next time I have a baby, I'm sneaking in my own pacifiers. When the nurse came in to lecture me on pacifier use and breastfeeding, I wanted to tell her to can it and just give me the d*mn pacifier. My boobs hurt and I'm not suddenly going to give my baby formula. And if I did, IT'S MY CHOICE.

Subscribe to:

Posts (Atom)